09 Mar Social Commerce Report + INFOGRAPHIC (2024)

Summary

What is Social Commerce?

In the dynamic digital landscape, social commerce has redefined the way products are bought and sold. This transformative concept enables direct transactions within social media platforms, eliminating the need for users to navigate away from their preferred networks. With intuitive features like the “buy now” button and autofill payments, the process becomes seamlessly accessible to diverse users.

Central to this evolution are “Super Apps,” exemplified by China’s pioneering approach, integrating social interactions and commercial transactions seamlessly.

Keep scrolling to learn more about current social commerce trends.

Social Commerce Stats

- In 2023, Facebook leads as the top US social commerce platform, with an estimated 65.7 million users set to make purchases on the platform. (Oberlo)

- The thriving social commerce industry in China is poised for significant growth, projected to increase by 11.4% annually, reaching an impressive $442.64 billion in 2023. (Yahoo Finance)

- In 2023, social commerce sales constitute 16.3% of China’s total e-commerce retail sales, indicating a robust upward trend. In contrast, the US stands at approximately 5%. (GMA)

- The average U.S. social buyer will spend approximately $641 via social commerce channels in 2023, a 23.8% increase in spending from 2022. (Insider Intelligence)

- 50% of internet users aged 16 to 24 prefer social media when searching brands over traditional web search. (Hootsuite)

- 97% of Gen Zers turn to social media as their main source of shopping inspiration. (Cymbio)

- There are approximately 107.6 million U.S. social commerce buyers in 2023. (Ecommerce Tips).

Our Social Commerce Surveys

Consumer Survey Methodology

The survey data presented in this report was collected from 1,000 users based in the US who submitted their responses in October 2023. Our target audience was users between 16 and 54+ years old.

Our goal was to understand their preferences when it comes to social commerce usage, online shopping behavior and preferences, livestream shopping approach and, overall, if and how they shop on social media.

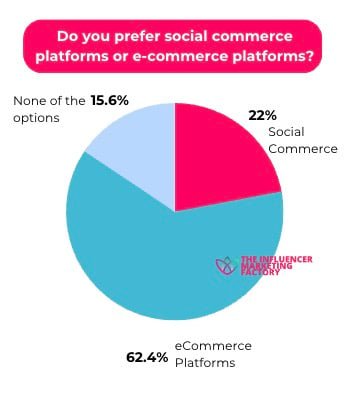

At the question “Do you prefer social commerce platforms or e-commerce platforms”

At the question “Do you prefer social commerce platforms or e-commerce platforms”

- 22% chose Social Commerce

- 62.4% eCommerce Platforms

- 15.6% None of the options

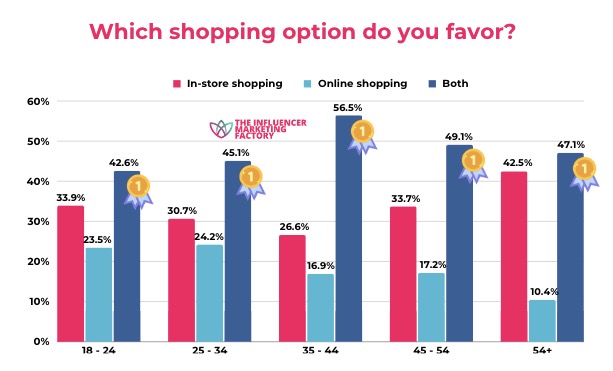

At the question “Which shopping option do you favor”, responders answered:

- In-store shopping: 33.6%

- Online shopping: 17.6%

- Both: 48.8%

The chart above shows which shopping option responders favor broken down by age.

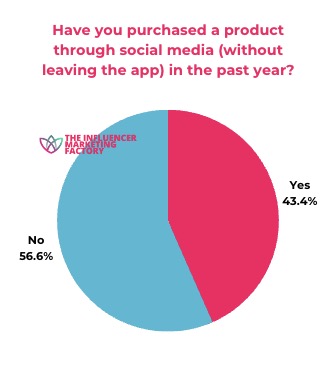

Out of a total of 1,000 US responders, 43.4% responded “YES” to “Have you purchased a product through social media (without leaving the app) in the past year”.

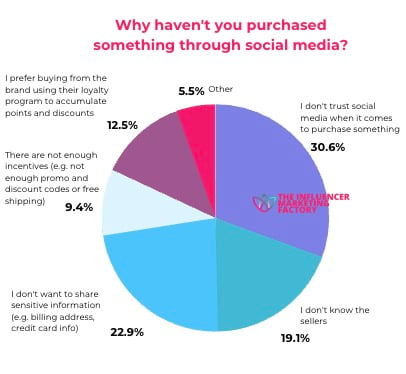

The remaining 56.6% that answered “NO”, explained also why:

- “I don’t trust social media when it comes to purchasing something”- 30.6%

- I prefer buying from the brand using their loyalty program to accumulate points and discounts – 12.5%

- There are not enough incentives (e.g. not enough promo and discount codes or free shipping) – 9.4%

- I don’t want to share sensitive information (e.g. billing address, credit card info) – 22.9%

- I don’t know the seller – 19.1%

- Other – 5.5%

Content Creators Survey

Creators Survey Methodology

The survey data presented in this report was collected from 500 content creators based in the US who submitted their responses in October 2023.

The data we are presenting was obtained from influencers.club and pertains to U.S.-based content creators on TikTok, YouTube, and Instagram with an average of 186k followers, with 90% falling in the age range of 18–44.

Our goal was to understand their preferences when it comes to social commerce usage, online shopping behavior and preferences, livestream shopping approach, and, overall, if and how content creators sell on social media.

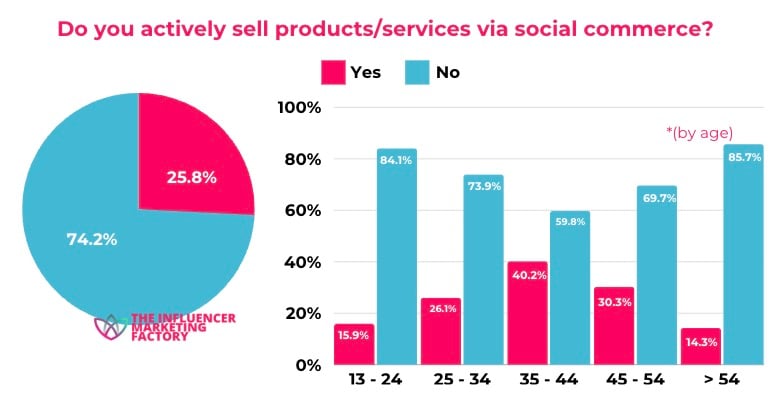

74.2% of the content creators surveyed answered “NO” to “Do you actively sell products/services via social commerce”?

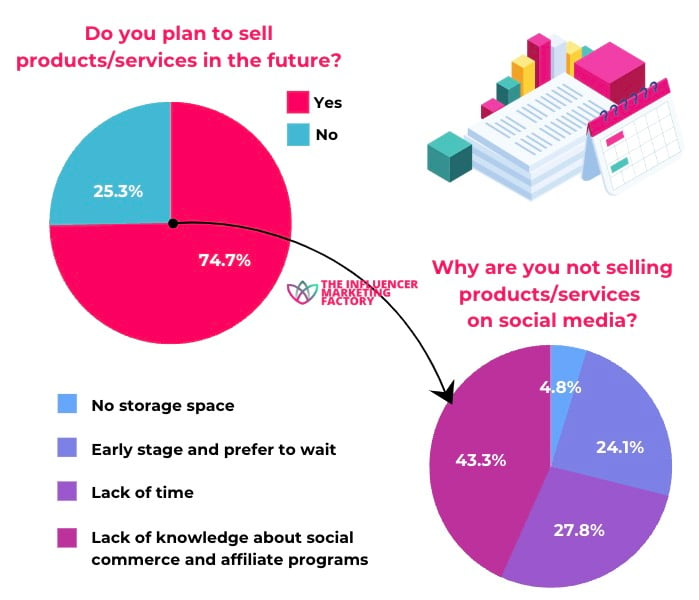

74.7% of the 500 Creators surveyed, stated they plan to sell products and services in the future. 25.3% said “NO” and the main reasons why are:

- 4.8% No storage space

- 24.1% Early stage and prefer to wait

- 43.3% Lack of knowledge about social commerce

- 27.8% Lack of time

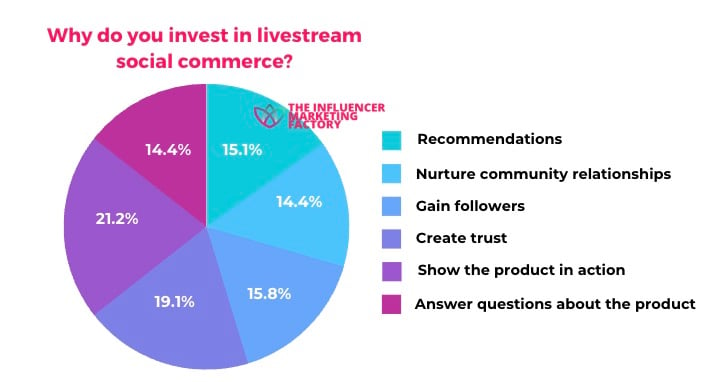

When it comes to livestreaming social commerce, this is why creators are currently investing time in it:

- 15.1% Recommendations

- 14.4% Nurture community relationships

- 15.8% Gain followers

- 19.1% Create trust

- 21.2% Show the product in action

- 14.4% Answer questions about the product

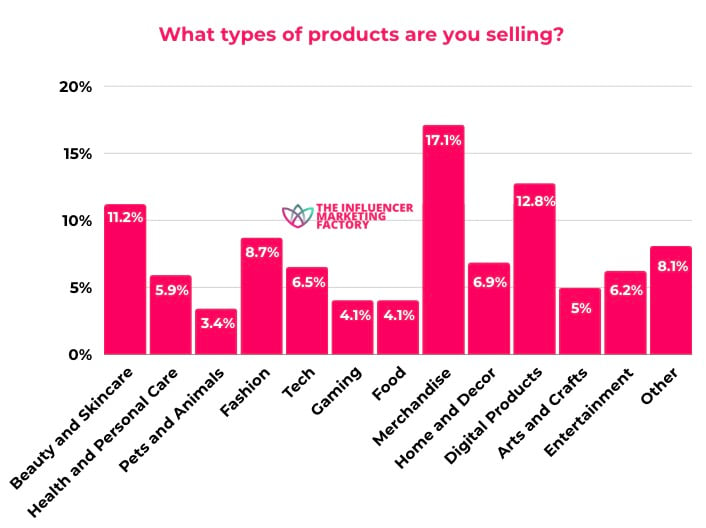

Merchandise (17.1%) is the number 1 type of product sold via social commerce by content creators, followed by digital products (12.8%), and then beauty and skincare in 3rd position with 11.2%.

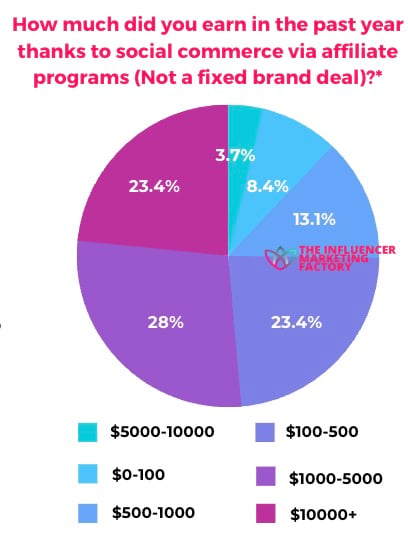

When asked how much they earned in the past year thanks to social commerce via affiliate programs, responders said:

- 8.4% $ 0-100

- 23.4% $ 100 – 500

- 13.1% $ 500 – 1,000

- 23.4% $ 1,000 – 5,000

- 3.7% $ 5,000 – 10,000

- 28% $ 10,000+

More insights from Our Exclusive Survey

- 97% of Gen Zers turn to social media as their main source of shopping inspiration.

- Facebook and Instagram Shops were top-rated by responders for social commerce experience, and Facebook Shop ranked #1 for checkout experience.

- Apparel, beauty products, and home products account for 60% of all social commerce purchases.

- Surveyed users ages 18-34 purchase via social commerce for limited-time offers, whereas users 35+ are incentivised by free shipping.

- 37% of responders report spending more than $100 USD on social commerce in the past year.

From Research on Social Commerce

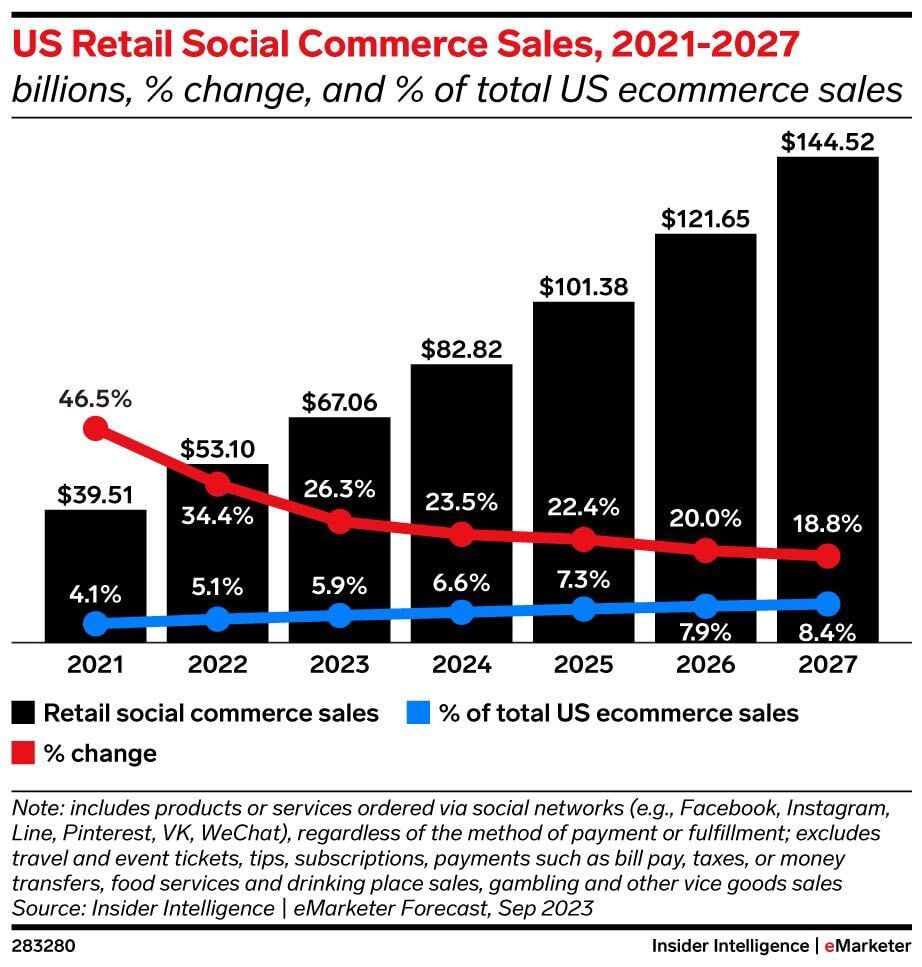

- eMarketer forecasted that US social commerce sales would rise by 29.8% to $68.92 billion in 2023.

- China’s social commerce industry is projected to reach $442.64 billion in 2023, Yahoo Finance reports.

- Insider Intelligence forecasts that the average U.S. social buyer will spend $641 via social commerce channels in 2023.

- The livestream e-commerce market will reach approximately $50 billion by the end of 2023, Coresight Research and Bambuser reported.

Social Media and Social Commerce

Social media apps such as Instagram, TikTok, and YouTube are always introducing new shopping features aimed to facilitate the shopping experience for users. Brands can maximize their online presence and customers can have access to their favorite social media while still being able to have a shopping experience and share new products with friends and family.

The social media platforms featured in our report are:

- TikTok

- YouTube

- Snapchat

Influencer Influence

According to the Influencer Marketing Hub’s 2023 State of Influencer Marketing report, “67% of those respondents who budget for influencer marketing intend to increase their influencer marketing budget over the next 12 months.” In this creator economy, why is influencer marketing spending on the rise? The Influencer Marketing Hub reported that 82% of respondents believe “that the quality of customers from influencer marketing campaigns is better than other marketing types,” a 13.9% increase since our 2021 report.

According to Tomoson, businesses are earning $6.50 for every $1 invested in influencer marketing campaigns. Insights from Influencer Intelligence affirm the growing importance of influencers in social commerce, with 62% of global marketers recognizing social commerce as the most popular objective for influencer marketing campaigns in the coming year. By partnering with The Influencer Marketing Factory, a leading influence marketing agency, brands can leverage these insights and trends to craft compelling influencer marketing strategies, enhancing their brand visibility and driving meaningful engagement and conversions.

Social Commerce Flow and User Experience

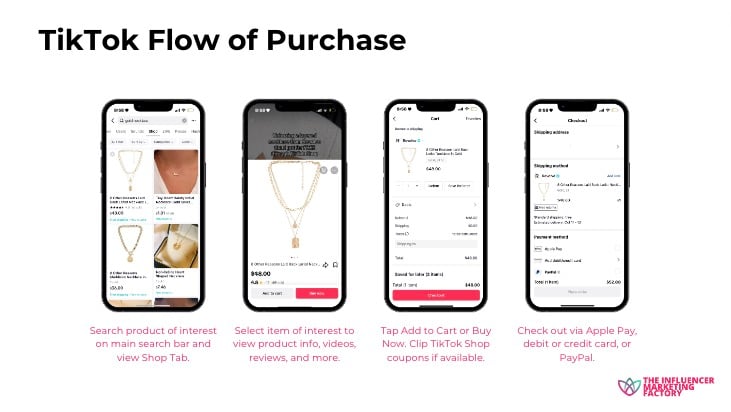

Social commerce streamlines the shopping experience, blending the convenience of e-commerce with the interactivity of social media. It starts with a simple product search on the main search bar, where users can access a dedicated Shop Tab. This tab presents a curated selection of products, allowing users to easily browse and select items of interest. Upon selection, comprehensive product information, engaging videos, and authentic reviews are at the user’s fingertips, enhancing the decision-making process.

The next step is seamless – with a single tap on ‘Add to Cart’ or ‘Buy Now,’ users can make instant purchases. The integration of TikTok Shop coupons adds an element of savings and excitement, encouraging savvy shopping. Finally, the checkout process is a breeze, thanks to the integration of familiar and secure payment options like Apple Pay, debit or credit cards, and PayPal. This efficient flow not only saves time but also creates a more enjoyable and engaging shopping experience, tailored to the modern consumer’s needs.

Livestream Shopping

Livestream shopping has become the perfect hub for brands and creators to connect with new audiences and interesting consumers. Creators can host lives on various platforms, such as Amazon or TikTok, to share their favorite products, voice their user testimonies, and give product recommendations relevant to their niche of content. Brands can utilize live-shopping events on their primary channels to give more expert solutions and recommendations, as well as trouble-shoot fulfillment issues, answer questions related to products, and inform consumers about current deals.

According to a recent report from Coresight Research and Bambuser, the livestream e-commerce market will reach approximately $50 billion by the end of 2023, nearly triple its size in 2021. Coresight Research and Bambuser projects that the livestream e-commerce market will surpass $67.8 billion in 2026, which will account for more than 5% of all e-commerce sales. As influencers and businesses big and small fine-tune their livestreaming business models, profit-sharing and identifying key strategies are repeatedly at the tops of conversations.

Livestream Revolution in China

According to data from Statista, more than 526 million people used live commerce In China, which accounts for approximately 48.8% of total internet users in the country. More than $500 billion in goods were sold during 2022 via Chinese live-streaming apps such as Douyin, according to Tencent.

According to GMA, Chinese internet users are much more tech-oriented compared to social media users in the West. In China, online users are in search of all-in-one platforms due to their convenience. Western social platforms are much more segmented by content style and level of privacy, but many top platforms are shifting to a Chinese approach, such as TikTok’s social commerce push to better resemble Douyin.

Buy Now, Pay Later

Buy Now, Pay Later services have become a staple in the e-commerce experience for primarily Gen-Z and Millennial users due to the appeal of splitting large payments without paying interest.

NerdWallet highlights the seven top Buy Now, Pay Later apps of 2023 to be the following:

- Affirm

- Afterpay

- Apple Pay Later

- Klarna

- PayPal

- Sezzle

- Zip

According to eMarketer, approximately 46.5% of Gen-Z users will use Buy Now, Pay Later services in 2023 when shopping online, whereas 40.6% of Millennials say the same.

Quotes from Social Commerce Experts

“Creators are the present and future of social commerce. We’ve seen a continued investment into the creator economy, and it’s because brands are experiencing full funnel business impact from their work with creators. From the beginning, we’ve been empowering brands to trust creators and bring them into every aspect of the creative process. There’s such a diversity of new ways to partner with creators and leverage their expertise. Across the industry, there’s been a shift from the “why” to the “how” of creator partnerships, and that’s where I see social commerce continuing to move.”

Adrienne Lahens – Global Head of Operations – TikTok Creator Marketing Solutions

Social commerce is set to significantly alter the landscape of brand interaction with mobile users, offering substantial enhancements in mobile conversion rates alongside a decrease in cart abandonment. This emerging field presents lucrative opportunities not only for brands but also for influencers, who are positioned to benefit from diverse income streams, including affiliate marketing, and garner greater earnings from their proprietary merchandise and services. Our research reveals a robust interest in social commerce, spurred by the advent of new features and tools on social media platforms. There’s a sense of eagerness and anticipation for its future progression, and we are excited to see the transformative effects social commerce will bring.

Alessandro Bogliari – CEO & Co-Founder of The Influencer Marketing Factory

“Plenty of people buy things they’ve seen on social media. But many of those transactions are happening outside of social apps, like by visiting a retailer’s website or offline. No social platform has cracked an easy check out experience right from their own app. TikTok has been stepping up efforts to push its new shopping features, but they could risk alienating users by inundating them with shopping content, when many are there for entertainment.

A few elements are at play, including trusting social networks with sensitive information such as payment data, and making the experience of shopping on social as good as on a retailer’s website, such as being able to see sizing, reviews and other information in one place. But most importantly it’s not a user behavior that’s normal in the US yet, and that takes time to adjust. For now, consumers are happy to take inspiration from social media or check out outside the platform.”

Kaya Yurieff – Creator Economy Reporter – The Information

“Right now we distinguish commerce driven by content as social commerce because the idea is new. That won’t be the case for long. Eventually all commerce – from digital to physical products, from e-commerce to retail, from global to local – will be social content driven. Soon enough, all commerce will be social commerce.”

Avui Gandhi – Partners with Creators